Welcome readers, if you’re still puzzling over your 2013 tax return, you’ve come to the right place. In this article, we’ll guide you through the ins and outs of filing your tax return for the year 2013. Whether you’re looking for tips on deductions, credits, or simply how to get started, we’ve got you covered. Let’s make tackling your 2013 taxes a breeze!

Lodge Your 2013 Tax Return Online: A Step-by-Step Guide

When it comes to filing your 2013 tax return online, it’s important to follow a step-by-step guide to ensure accuracy and efficiency. By lodging your 2013 tax return online, you can take advantage of the convenience and speed that online platforms offer. Here is a practical guide to assist you in completing this process smoothly:

Step 1: Gather Your Documents

Before you begin, make sure you have all the necessary documents at hand. This includes your income statements, expense receipts, deductions, and any other relevant paperwork for the 2013 tax year.

Step 2: Choose a Reputable Online Platform

Select a trusted online platform or software to lodge your 2013 tax return. Ensure that the platform is secure and compliant with tax regulations to safeguard your personal information.

Step 3: Create an Account

If you are using a new platform, you may need to create an account. Provide the required information and set up your profile before proceeding to input your tax details.

Step 4: Enter Your Information

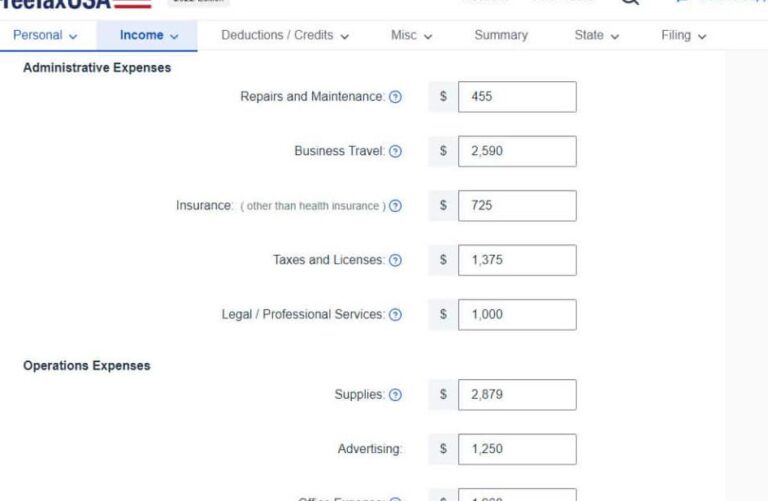

Follow the prompts to enter your income, expenses, deductions, and any other relevant financial information for the 2013 tax year accurately. Double-check your entries to avoid errors.

Step 5: Review and Submit

Once you have entered all your information, take the time to review your 2013 tax return. Ensure all details are correct before submitting your return electronically. Submission deadlines may apply, so be mindful of the due date.

By following these steps, you can efficiently lodge your 2013 tax return online and fulfill your tax obligations for the year. Remember to keep a copy of your return for your records and seek professional assistance if needed.

Understanding Tax Audits: How Far Back Can the Tax Office Look?

When it comes to tax audits and the timeframe within which the Tax Office can look back, understanding the rules can help you prepare and protect yourself. In the context of a 2013 tax return, it’s essential to know your rights and obligations.

The general rule is that the Tax Office can conduct an audit within a certain timeframe, typically within the last three to six years. However, in some cases, they can go back further, especially if there is suspicion of fraud or significant underreporting of income.

To ensure compliance and minimize any potential issues with your 2013 tax return, here are some practical steps you can take:

- Keep all relevant documentation from 2013, such as receipts, invoices, and bank statements.

- Review your tax return from 2013 to ensure accuracy and completeness.

- Consider seeking advice from a tax professional to review your tax return and provide guidance on potential audit risks.

By being proactive and organized, you can better navigate any potential tax audits related to your 2013 tax return. Remember, cooperation with the Tax Office and transparency in your financial affairs are key to resolving any issues that may arise.

Unlocking Past Finances: How to Retrieve Old Tax Returns in Australia

If you need to retrieve your 2013 tax return in Australia, there are a few steps you can take to access this important financial document. Here’s a guide to help you unlock your past finances:

1. Contact the Australian Taxation Office (ATO)

The first and easiest step is to get in touch with the ATO. You can request a copy of your 2013 tax return by contacting them directly. Provide your personal details and any relevant information to assist them in locating your records.

2. Use myGov Account

If you have a myGov account linked to the ATO, you may be able to access your past tax returns online. Log in to your myGov account, navigate to the ATO section, and look for the option to view your tax documents. You might find your 2013 tax return there.

3. Seek Professional Help

If you’re having trouble retrieving your 2013 tax return on your own, consider seeking assistance from a tax professional. They can guide you through the process and help you obtain the necessary documents from the ATO.

By following these steps, you should be able to retrieve your 2013 tax return in Australia and gain access to your past financial information.

Unfiled Tax Returns in Australia: Consequences & Solutions

Unfiled tax returns in Australia, especially for the year 2013, can lead to various consequences if not addressed promptly. It’s crucial to understand the potential repercussions and explore effective solutions to rectify the situation. Here’s a concise guide to help you navigate through this issue.

Consequences of Unfiled 2013 Tax Returns:

When 2013 tax returns are left unfiled, individuals may face the following consequences:

- Accumulation of penalties and interest

- Loss of potential refunds

- Legal actions by the Australian Taxation Office (ATO)

- Difficulty in obtaining loans or financial approvals

Solutions for Unfiled 2013 Tax Returns:

To address unfiled 2013 tax returns effectively, consider the following steps:

- Gather Financial Records: Collect all relevant financial documents for the year 2013.

- Seek Professional Help: Consult a tax professional or accountant to assist in preparing and filing your returns.

- Utilize ATO Services: Utilize online tools provided by the ATO to submit your overdue returns.

- Negotiate with ATO: Communicate with the ATO to discuss payment plans or request remission of penalties.

By taking proactive steps to address unfiled 2013 tax returns, individuals can avoid potential consequences and ensure compliance with tax regulations in Australia. Remember, seeking professional advice and acting promptly is key to resolving this issue efficiently.

As we wrap up our discussion on the 2013 tax return, a final tip to keep in mind is to always double-check your filing information to ensure accuracy and avoid potential penalties. Remember that even though we strive to provide helpful information on this blog, it’s crucial to consult with a professional for personalized advice tailored to your specific situation.

We hope you found this article informative and useful. If you have any questions, tips, or experiences to share regarding filing your 2013 tax return, feel free to leave a comment below. Don’t forget to share this article with your friends and family on social media to help them navigate their tax returns as well. And remember, there are always more related articles on our blog for you to explore!

Thank you for reading, and we look forward to seeing you in our future posts!

If you found this article informative and engaging, be sure to visit our Income Tax section for more insightful articles like this one. Whether you’re a seasoned enthusiast or just beginning to delve into the topic, there’s always something new to discover in auslegalhub.com. See you there!